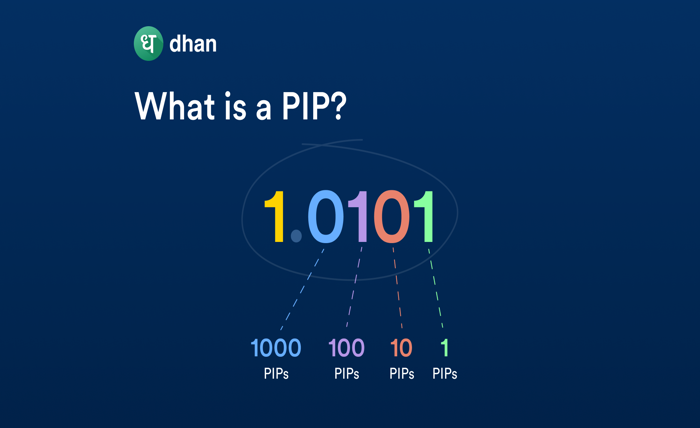

A pip is the smallest step a currency price usually moves. Think of it as the “cent” of forex. When EUR/USD goes from 1.0850 to 1.0851, that’s one pip. When USD/JPY moves from 157.20 to 157.21, that’s also one pip. Traders use pips to talk about change, risk, targets, and costs. If you learn pips early, you can read charts with calm eyes, plan your trades with clear risks, and speak the same language as your platform and your peers.

Before you get deep into charts, try a quick tool check. Open a pips calculator and enter a pair, trade size, and your account currency. You’ll see how much money one pip is worth for that setup. Use this as a habit before each trade. When you know the cash value of a pip, you can size the position so one normal loss does not break your day.

How a pip works on common pairs

Most pairs quote to four decimals. On EUR/USD, a move from 1.0850 to 1.0856 is 6 pips. On GBP/USD, 1.2710 to 1.2695 is 15 pips down. JPY pairs are a bit different: they quote to two decimals, so 157.20 → 157.35 is 15 pips. Your platform may also show a fifth or third decimal (called a “pipette”), which is one tenth of a pip. Focus on full pips for planning; use pipettes for tight timing.

Pipettes, spreads, and what you actually pay

A pipette is one tenth of a pip. If EUR/USD is 1.08508, the last “8” is the pipette. Spreads—the small gap between bid and ask—are often quoted in pipettes, so 0.3–0.8 pip spreads may be shown as 3–8 pipettes. Why it matters: your trade starts slightly negative by the spread. If your spread is 0.6 pips and your target is 10 pips, you still net about 9.4 pips before fees. On fast moves and thin times (late Friday, major news), spreads can widen, so give your stop a bit of room and avoid trading when the book is thin unless you know the risks.

Pip value and position size

You don’t need heavy math to plan size. Use the calculator, set your risk per trade (a small, fixed amount), and solve for how many units or lots fit that risk given your stop in pips. A simple flow:

- Pick where your idea fails on the chart (that’s your stop level).

- Measure the distance from entry to stop in pips.

- Use the tool to find the pip value for your pair and account currency.

- Adjust position size so (pips to stop × pip value) ≈ your planned loss.

Example: you buy EUR/USD with a 12-pip stop and plan to risk $20. If one pip at your size would be $1.50, then 12 pips ≈ $18. That fits. If one pip would be $3, then 12 pips would cost $36—too high—so you cut the size. Simple, clear, safe.

Pips vs points vs ticks

In forex, “pip” is the standard. Some platforms use “point” to mean the same thing; others say a point is a pipette. Read your platform’s help text to avoid mix-ups. “Tick” is any price change, even a tiny one; in forex, it’s less common as a planning unit. For clean notes and fewer errors, stick to pips and pipettes on currency pairs.

Five mistakes that cost beginners money

- Guessing size: trading a fixed lot each time without checking pip value.

- Tight stops on noisy pairs: placing a 5-pip stop on GBP pairs during a busy session and getting clipped.

- Ignoring spread at entry: opening right before a news spike, paying a wide spread, and starting far behind.

- Mixing pair types: using EUR/USD habits on USD/JPY without minding two-decimal quotes.

- Moving stops after entry: turning a planned loss into a bigger one because “it might bounce”.

A quick workflow you can use today

Start with the chart and the story. Where is price finding support or meeting sellers? Pick your level, then set the stop where your idea clearly fails. Count the pips to that stop. Open the pip tool, check the pip value for the pair and size, and fit the risk to your plan. Place the order. After the trade, write two lines: entry, stop, result in pips, and one note on what you did well or what you will fix next time. In a week you’ll see patterns you can act on—late entries, stops too tight, or trades near news—you’ll correct them one by one.

Forex rewards a calm and steady method. Pips are the simple unit that ties it all together: they let you frame targets, set stops, and translate chart ideas into cash risk you can accept. Keep the process light: know the pip, check its value, size the position to fit your rule, and take the result without drama. That’s how you build your skill that lasts beyond one lucky trade.